The Paris escort industry faced an unprecedented shock when the COVID‑19 pandemic swept across Europe in early 2020. Paris escort industry had to rewrite its playbook overnight, moving from street‑level bookings to fully digital workflows while grappling with lockdowns, health mandates, and a sudden dip in tourist traffic.

Pre‑pandemic baseline: A bustling market

Before 2020, the tourism industry supplied roughly 60% of the client base for Paris’s escort services, according to a 2019 market report by the French Adult Services Association. Agencies in the 1st and 8th arrondissements reported average monthly revenues of €120,000, while independent escorts earned around €6,000 per month through personal networks and online ads.

Lockdown shock: Immediate closures and lost income

When the French government imposed a nationwide stay‑at‑home order on March 17, 2020, most physical venues-particularly brothels in the 9th arrondissement-shut their doors. A quick survey of 200 escorts conducted by the Paris Nightlife Research Institute showed that 78% lost more than half of their income within the first month, and 32% considered leaving the profession altogether.

Digital pivot: Rise of online platforms

Faced with empty streets, many escorts turned to specialized online platforms such as EliteCompanion and ParisEscorts.net. These sites offered encrypted messaging, virtual consultations, and contactless payment options. By June 2020, platform registrations rose 210% compared with the previous quarter, and 45% of newly registered users reported that they were former street‑level workers.

- Instant booking tools reduced the average lead time from 48 hours to under 6 hours.

- Virtual “date” sessions (chat, video) became a new revenue stream, accounting for up to 12% of total earnings for some escorts.

- Secure digital payment systems like Stripe and crypto wallets helped avoid cash handling.

Financial fallout: Numbers that matter

Industry‑wide revenue dropped an estimated 45% in 2020, with the steepest decline occurring in high‑end agencies serving affluent tourists. Independent escorts fared slightly better, seeing a 30% dip, thanks to their agility on digital channels. The same 2019 report highlighted a shift in client demographics: domestic clients rose from 20% to 55% of total bookings during the pandemic.

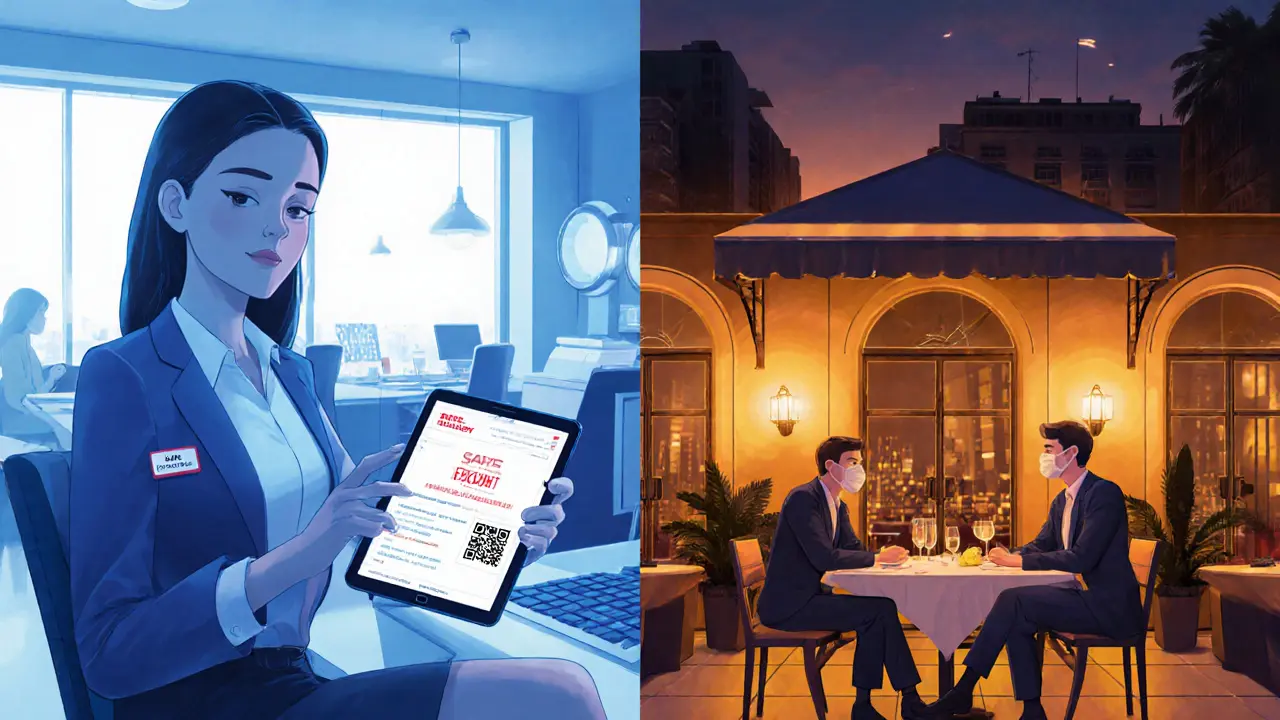

Health protocols and safety certifications

To reassure clients, many agencies adopted strict health protocols endorsed by the Paris Health Authority. These included mandatory rapid antigen tests before each appointment, temperature checks, and the use of medical‑grade disinfectants. Some organizations introduced a "Safe Escort" badge-essentially a safety certification-displayed on profiles to signal compliance.

Regulatory response: Balancing safety and liberty

While the French government relaxed certain restrictions for adult‑service venues in July 2020, it also imposed a new licensing requirement for any escort who accepted payments via digital means. This led to a brief surge in informal operations, as some providers chose to operate off‑grid to avoid paperwork.

Tourism's lingering shadow

Even after borders reopened in summer 2022, the tourism industry recovered at a slower pace than before the pandemic. International visitors accounted for just 40% of the client mix in 2023, compared with 60% in 2019. This shift forced escorts to diversify services-offering longer‑term companionship packages and expanding into “wellness” experiences such as massage and private dinner outings.

Independent vs. agency‑based escorts: A new equilibrium

Data from the 2023 Paris Escort Survey revealed that 58% of active escorts now identify as independent, up from 42% before 2020. Agencies that survived the crisis did so by investing in tech, offering health‑screening logistics, and taking a cut of digital earnings rather than cash. Independent workers benefit from keeping 100% of their fees, but they also bear the full burden of compliance and client acquisition.

Future outlook: Which changes will stick?

Experts predict a hybrid model will dominate the post‑pandemic era. Physical encounters will remain a core offering, especially for high‑spending tourists, but digital touchpoints-online bookings, virtual introductions, and contactless payments-are likely to stay permanent. The "Safe Escort" badge, originally a pandemic response, is now being discussed as a standard industry credential.

- Invest in reputable online platforms that prioritize security.

- Maintain health‑screening routines to build client trust.

- Diversify revenue streams beyond traditional appointments.

Quick comparison: Pre‑pandemic vs. Pandemic era

| Metric | 2019 (Pre‑pandemic) | 2020‑2021 (Pandemic) |

|---|---|---|

| Average monthly revenue per agency | €120,000 | €68,000 (‑43%) |

| Independent escort earnings | €6,000 | €4,200 (‑30%) |

| Client origin (tourists) | 60% | 40% |

| Digital platform registrations | 12,000 | 25,200 (+210%) |

| Average booking lead time | 48 hours | 6 hours |

Frequently Asked Questions

Did the pandemic completely shut down escort services in Paris?

No. While many physical venues closed during lockdowns, a large portion of the industry moved online and continued operating through virtual bookings and contactless services.

How much did revenues drop for agencies?

Average monthly revenue for established agencies fell about 43% in 2020, dropping from roughly €120,000 to €68,000.

What health measures are now standard?

Most reputable services require a negative rapid antigen test before each appointment, perform temperature checks, use disposable gloves and medical‑grade disinfectants, and display a "Safe Escort" certification on their profiles.

Are independent escorts earning more than agencies now?

Independent escorts keep 100% of their fees, which can offset lower client volume. However, agencies still generate higher total revenue because they serve more clients and handle logistics.

Will virtual services continue after the pandemic?

Yes. Virtual introductions, secure online payments, and health‑screening protocols have become part of the new normal and are expected to remain even as tourists return.